Below Is the Company's Cash T-account.

D Collection from customers. A T Account is the visual structure used in double entry bookkeeping to keep debits and credits separated.

Solved Below Is The Company S Cash T Account Cash Beg Chegg Com

Thus the T-account is the term that is used for the set of the financial records which use the double-entry bookkeeping Double-entry Bookkeeping Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit.

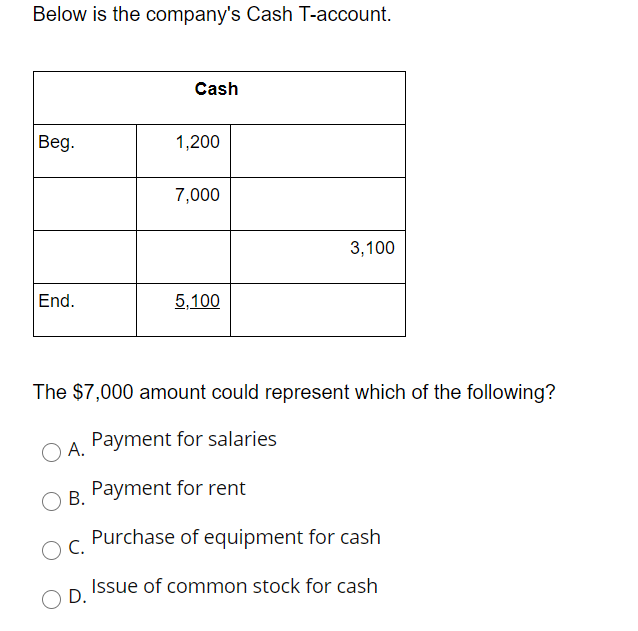

. Furthermore the number of transactions entered as. The answer is option third - Payment for salaries Purchase of supplies on account will not be credited to cash account a. For example on a T-chart debits are listed to the left of the vertical line while credits are listed on the right side of the vertical line making the companys general ledger easier to read.

To increase the asset Cash the account needs to be debited. Purchase of supplies on account. 1200 5200 3100 End.

This double-entry system shows that the company now has 20000 more in. D Collection from customers 7 A company received an order from a customer in June for services to be provided. The 3100 amount could represent which of the following.

Common Stock has a credit balance of 20000. Investors may value a company below cash value if. The company purchased office supplies for 1250 cash.

Part of the equipment was sold on the last day of the current year for cash proceeds. See the detailed lesson on how to balance a T-account for more information. This is posted to the Cash T-account on the debit side left side.

Below is the companys Cash Taccount. Determine the ending balance of each T-account. View the full answer.

Video Explanation of T Accounts. What is a T Account. 1200 5200 3100 End.

Payment for rent C. Balance BF vs Balance CF. All the main T-accounts in a business fall under the general ledger.

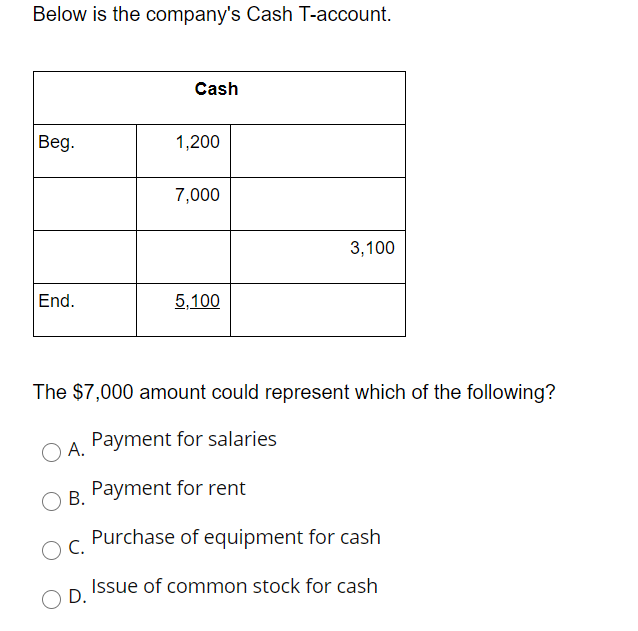

A Ending balance of cash. 3300 The 5200 amount could represent which of the following. 3300 Dr The 5200 amount could represent which of the following.

C Payment for salaries. Multiple Choice Purchase of. In the journal entry Cash has a debit of 20000.

Purchase of equipment for cash Issue of common stock for cash D. The equipment was depreciated on a straight-line basis with an estimated useful life of 10 years and a salvage value of 190. A T-account is an informal term for a set of financial records that uses double-entry bookkeeping.

My Reading List. Shown below are the T-accounts relating to equipment that was purchased for cash by a company on the first day of the current year. It is just a term used in accounting to mean that you will take a balance from one period and carry it forward copy it to the next period.

1200 5200 3300 3100 End. Ending balance of cash. On a companys financial statements for 500000.

Below is the companys Cash T-account. Below is a short video that will help explain how T Accounts are used to keep track of revenues and expenses on the income statement. Balance cf is just an entry used in calculating that the closing balance is 19100 on the debit side.

The Balance bf shown above is the actual closing balance of the bank account a debit balance. Purchase of supplies on account B. Ending balance of cash C.

Collection from customers Cash Beg. Hope that makes sense. Below is the companys Cash T-account.

A Purchase of supplies on account. Shown below are the T accounts relating to equipment that was purchased in cash by a company on the first day of the current year. The company purchased S10050 of office equipment on credit.

The simplest account structure is shaped like the letter T. B Purchase of supplies on account. For example we will carry forward the balance of 600 cash on January 31 to February 1 the next period.

1200 7000 3100 End. 5100 The 7000 amount could represent which of the following. The Balance bf indicates that the debit side is greater than the credit side by 19100 and that we have 19100 in our bank account at the end of May the.

1200 Dr 5200 Dr 3100 Cr End. For example land and buildings equipment machinery vehicles financial investments bank accounts inventory owners equity capital liabilities - the T-accounts for all of these can be found in the general ledger. This is posted to the Common Stock T-account on the credit side right side.

Cach Beg 1200 5200 1100 The 3100 amount could represent. Below is the companys Cash T-account. On June 1 2021 a company borrows 5000 from its bank.

The account title and account number appear above the T. Below is the companys Cash Taccount The 5200 amount could represent which of the following. On January 5 2019 purchases equipment on account for 3500 payment due within the month.

For asset accounts which include cash accounts receivable Accounts Receivable Accounts Receivable. Payment for salaries OA. As a result the companys asset Cash must be increased by 5000 and its liability Notes Payable must be increased by 5000.

Help Below is the companys Cash T-account. To increase the companys liability Notes Payable this account needs to be credited. Debits abbreviated Dr always go on the l.

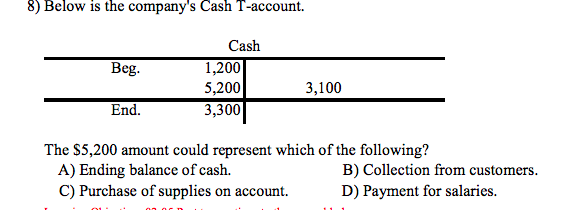

C Collection from customers. 3300 The 3100 amount could represent which of the following. 3300 The 5200 amount could represent which of the following.

The equipment was depreciated on a straight-line basis with an estimated useful life of 10 years and a residual value of 100. Trading below cash is when a companys stock price indicates a market value that is lower than the firms total cash holdings on its balance sheet. 1200 5200 3100 End.

Ending balance of cash C. Payment for salaries D. The general ledger is simply our main ledger in accounting.

20 Below is the companys Cash T-account. Purchase of supplies on account B. If a business owner loses 5000 of the companys cash while gambling the cash account which is an asset.

Solved Below is the companys Cash T-account. Kacy Spade owner invested 100750 cash in the company b. B Ending balance of cash.

A Purchase of supplies on account B Ending balance of cash C Payment for salaries or various expenses. Payment for salaries D. 6 Below is the companys Cash T-account.

Expense and owners drawing accounts. After recording the transactions post them to T-accounts which serves as A the general ledger for this assignment.

Solved 8 Below Is The Company S Cash T Account Cash Beg Chegg Com

Solved Below Is The Company S Cash T Account Cash 1 200 Chegg Com

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

0 Response to "Below Is the Company's Cash T-account."

Post a Comment